An analyst has explained how data from an on-chain indicator could indicate that there is still a bullish trend going on for Bitcoin despite the latest pullback.

Bitcoin Coinbase Flow Pulse Still Signals a Bull Market

In a new after on X, CryptoQuant author Axel Adler Jr talked about the latest trend in the Bitcoin Coinbase Flow Pulse. The “Coinbase Flow pulse” refers to an indicator that tracks the total amount of BTC flowing into Coinbase from other centralized exchanges.

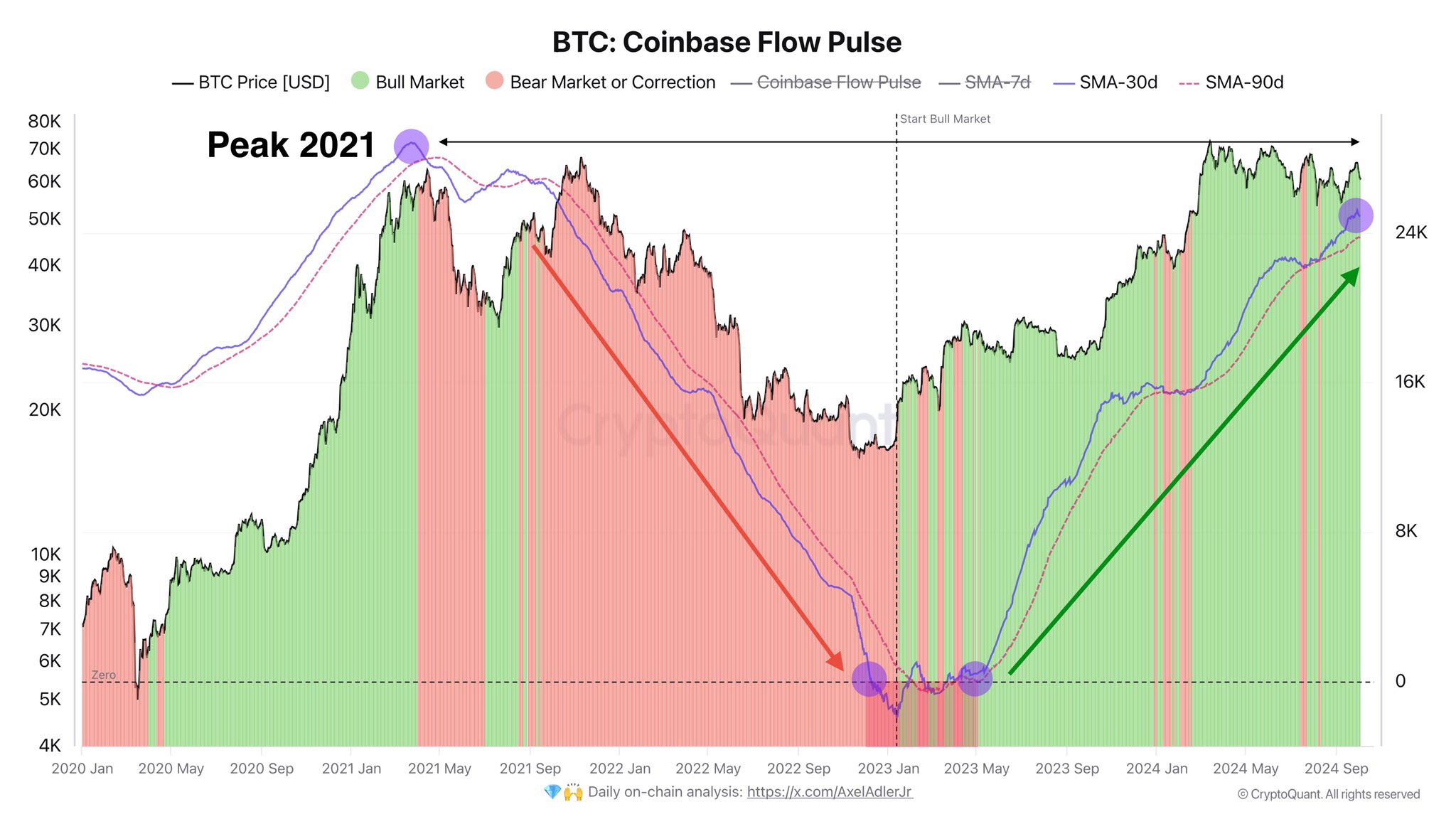

Here is the chart shared by the analyst, showing the trend in the 30-day and 90-day simple moving averages (SMAs) of this indicator over the past few years:

Looks like the two lines have both been heading up for a while now | Source: @AxelAdlerJr on X

As shown in the chart above, the Bitcoin Coinbase Flow Pulse has seen both SMAs rise since early 2023, indicating that there has been a long-term trend of increasing inflows into Coinbase from other platforms.

Currently, the 30 days is still above 90 days, meaning the inflow continues to accelerate. From the perspective of this indicator, it can be assumed that Bitcoin is in a bull market when these two lines are arranged in this way.

The periods in which this condition applied are marked in green in the graph. It appears that the measure has only experienced a bearish crossover a few times since the start of this uptrend, with each ‘bear’ period lasting only a brief moment.

In recent days, Bitcoin price has observed a notable bearish momentum, but so far this indicator shows no signs of a bearish cross. “Despite the local pullback, the bullish trend persists,” the analyst notes.

As for why a transfer from other exchanges to Coinbase is considered bullish, the reason lies in the type of users who conduct their trading activities on the platform. Coinbase is mainly used by US-based investors, especially the large ones institutional entitieswhich are usually the drivers of the market.

The influx into Coinbase implies that demand from such users is increasing, which could ultimately impact the value of the cryptocurrency. The Coinbase Flow Pulse is not the only indicator used to gauge US investor demand. Coinbase Premium Gapwhich tells us about the short-term changes in demand.

This indicator measures the difference between Bitcoin prices listed on Coinbase (USD pair) and Binance (USDT pair). Binance is used by global traffic, so the value of this metric essentially represents the difference in behavior between US and global users.

Below is a chart for the 1-hour version of this indicator, shared by an analyst in a CryptoQuant Quicktake after.

The value of the metric appears to have gone up recently | Source: CryptoQuant

As the quant highlighted in the chart, the Bitcoin 1-hour Coinbase Premium Gap has recently shown a break above the daily value, which could be a sign that buying among Coinbase users is starting to pick up.

BTC price

Bitcoin has made a sideways move since the plunge at the beginning of the month, as the price is still trading around $61,300.

The price of the coin has seen a net decline over the past few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com