Bitcoin has soared to new all-time highs, reaching $76,500 following Donald Trump’s victory in the US elections. This price breakout has reignited optimism among investors, especially among US traders, with demand increasing significantly since the election results. Trump’s pro-crypto stance has played a key role in boosting market sentiment, especially among institutional investors.

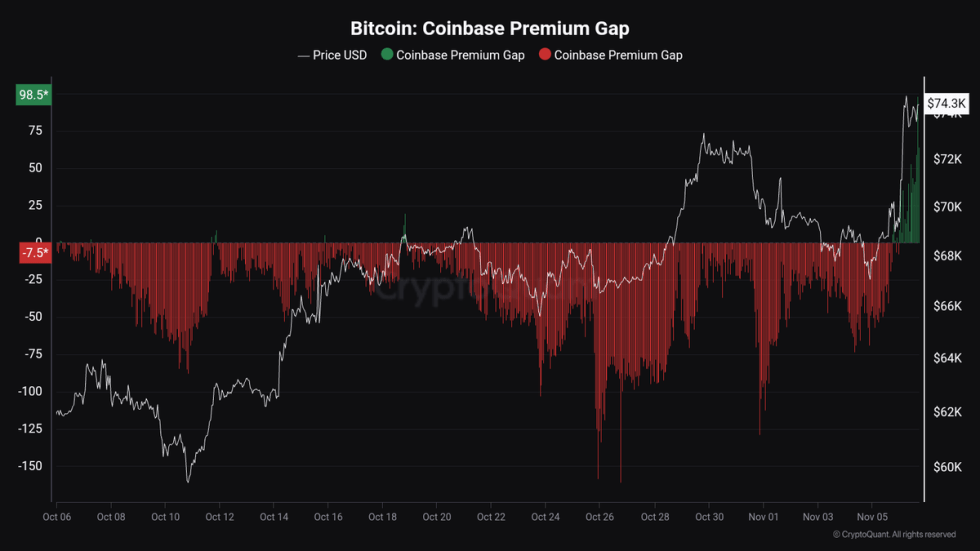

Data from CryptoQuant shows that there has been a notable increase in institutional demand, especially from US investors, which has recently driven the price of BTC higher. The Coinbase Premium Index, a critical metric that tracks the difference between the price of BTC on Coinbase and other exchanges, turned positive for the first time since October 18, signaling a shift in market dynamics and the return of strong buying interest in the US market.

This surge in demand suggests that Bitcoin’s bullish momentum may be just the beginningwith analysts expecting continued upward pressure. As US institutional investors continue to enter the market, BTC’s path to higher prices looks increasingly likely. The coming weeks will be crucial as market participants await further developments, including the Federal Reserve’s decision on interest rates, which could impact BTC’s next steps.

Buy Bitcoin aggressively on Coinbase

Bitcoin is entering a bullish phase following the election of Donald Trump as the new US president, a development that has revived optimism among pro-crypto investors. In recent days, the price has risen above previous record highs, driven by aggressive demand from US players. Trump’s favorable stance on cryptocurrency has played a major role in fueling this new wave of buying pressure.

Crucial data from CryptoQuant analyst Maarunn supports this bullish outlook. Maartunn highlighted that the Coinbase Premium Gap rose above $100 yesterday, a clear sign of increased demand in the US market.

The Coinbase Premium Gap is the price difference between Bitcoin on Coinbase, one of the largest US exchanges, and Binance, a global exchange. When this gap widens, it indicates that US buyers are willing to pay a premium for BTC, indicating strong demand and the presence of significant liquidity in the market.

According to Maarunn, this large premium difference can only be caused by a major player aggressively bidding for BTC. This suggests that institutional investors or large whales are driving the price action, further fueling bullish sentiment.

With the US market showing such strong demand and the political environment becoming more favorable for crypto, Bitcoin’s path to new highs seems promising. The coming weeks will be crucial in determining how far this bullish momentum can take BTC.

BTC is rising and entering uncharted territory

Bitcoin has entered uncharted territory and is now trading at $75,000 after several days of uncertainty surrounding the US elections. The market has shown very bullish sentiment, with BTC remaining above its previous all-time high of $73,800, a key level that many analysts were closely watching. This price action signals continued optimism among investors, with many expecting even more upside potential in the coming weeks.

Despite the positive outlook, Bitcoin’s price is at a critical juncture. If it fails to hold above USD 73,800, the price could enter a consolidation phase, with potential support around the USD 72,500 level. If the price stays above this level, it can maintain its bullish momentum and pave the way for further gains.

However, if Bitcoin falls below $72,500, it could signal a shift in momentum and pave the way for a deeper pullback. The coming days will be critical as the market continues to digest the results of the US elections and the potential impact of the Federal Reserve’s decisions on interest rates. For now, the path to new highs remains clear as long as Bitcoin remains above these key support levels, but any sustained decline could challenge the current bullish outlook.

Featured image of Dall-E, chart from TradingView